Tesla is a company that is known primarily for its electric vehicles. However, that may not be the case for long as Tesla continues diversifying its revenue streams with products such as their Powerwall, Solar Panels, Supercharging stations, and potentially Robotaxi service and Optiumus, their upcoming humanoid. This strategic move to focus on other products allows Tesla to position itself similarly to Amazon, which successfully expanded beyond its initial e-commerce business. This strategic diversification is crucial for Tesla's sustained growth.

Tesla's Multifaceted Revenue Streams

Electric Vehicles (EVs): Tesla is More than Just a Car Company. Tesla's primary revenue source is still its electric vehicles. The company's models — Model S, Model 3, Model X, and Model Y — have made their mark in the industry and cemented Tesla as a leader in the EV market. However, as previously mentioned, Tesla's strategy extends beyond just selling cars. The company continues to innovate with software updates and additional features like Autopilot and Full Self-Driving (FSD) capabilities, which generate ongoing revenue through subscriptions and upgrades. If you'd like to read more about FSD capabilities and other likely use-cases for AI in the world, I have attached an article below:

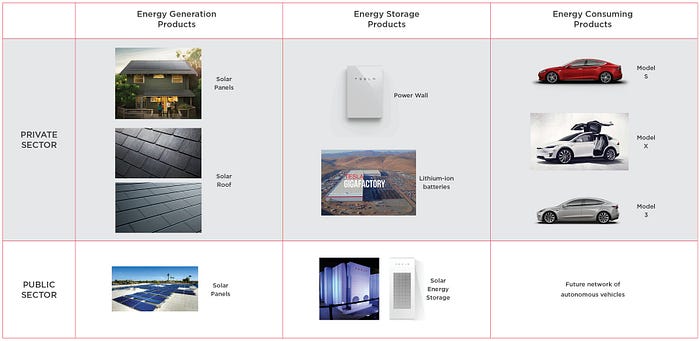

Energy Generation and Storage: Tesla is Focused on Powering the Future. Tesla has made significant progress in the renewable energy market with products like solar panels and the Powerwall battery pack. These products allow consumers to generate and store clean energy, reducing reliance on traditional power grids and promoting sustainability. Tesla's energy solutions are available for both residential and commercial use which allows the company to expand their market reach and create additional revenue streams.

Services and Other Revenue: Tesla is Focused Beyond the Vehicle Sale. As mentioned, Tesla generates revenue from various services including vehicle maintenance, repairs, extended warranties, and merchandise sales. The Autopilot and Full Self-Driving software subscriptions also provide continuous revenue and seem to be quite popular among Tesla owners. This diversified approach enhances customer loyalty and generates substantial income that goes beyond the initial vehicle sale which other manufacturers often do not see.

Licensing and Partnerships: Tesla Continues Expanding its Influence. Tesla's technology, particularly its batteries and powertrains are also being licensed to other companies. This strategic move not only opens up new revenue channels but also positions Tesla as a key player in the broader EV and energy sectors.

Comparing Tesla's Strategy to Amazon

Just like Amazon, Tesla is diversifying its revenue streams to build a more flexible and strong business model. Amazon started with books but eventually expanded into cloud computing, entertainment, and more. This diversification has insulated Amazon from sector-specific downturns and created multiple growth engines, one of their largest being AWS. Similarly, Tesla's focus into energy solutions, software services, and licensing mirrors this strategy and ensures that the company's success is not solely dependent on vehicle sales.

In "The Psychology of Money," Morgan Housel discusses the concept of "success in the tails," highlighting that significant successes often come from a few high-risk, high-reward bets. Most people only notice the success of companies and individuals rather than all of the trial and errors that lead up to that moment. Amazon's Fire Phone was a notable failure, but the company's willingness to take risks has also led to massive successes like AWS. Tesla's aggressive investment in FSD, energy storage, and even ventures like the humanoid robot Optimus demonstrates this approach. These initiatives may not all succeed, but the potential payoffs from those that do could be substantial.

Innovation and Global Expansion

Tesla invests heavily in research and development and continues to push the boundaries of what is possible in the automotive and energy industries. Innovations in battery technology, autonomous driving, and energy storage are examples of how Tesla aims to stay ahead of the competition. The companies focus on what will be considered normal in the future has the opportunity to position them at the top of several industries. Also, Tesla has been making significant efforts to expand globally into Europe and Asia, which highlights its determination to dominate the EV market. This expansion is crucial, given the competitive pressures in markets like China, where domestic automakers pose a significant challenge.

The Future of Tesla's Success

Tesla's future looks promising as they continue to focus on forming multiple revenue streams providing financial stability and growth potential. By diversifying its business model and taking strategic risks, Tesla is likely well-positioning itself to maintain its leadership in the EV market and beyond. This multifaceted and strategic approach, combined with a strong commitment to innovation mirrors the successful strategies employed by tech giants like Amazon.

References:

- NextBigFuture. "Current and Future Tesla Revenue Streams"

- South China Morning Post. "Tesla shows its humanoid robot Optimus at China AI conference, but behind glass"

- Tesla.

- Untaylored. "Decoding Tesla's Business Model and Revenue Streams"