Introduction

Europe is abolishing paper invoices to authorities (Business to Government, B2G) since 2020. As first european country, Italy additionally banned Business-to-Business (B2B) paper invoices in 2019.

Italy simultaneously introduced a continuous transaction control (CTC) system, transmitting the VAT amount of every individual invoice to the fiscal authorities. This has minimized tax fraud so effectively as if they had raised VAT by 3%. Hungary followed 2021 with a lighter, reporting-only model, which allows but does not require e-invoices. France will follow with a model that will also require e-invoices between July 2024 and January 2026.

The EU intends to introduce A CTC around 2028 for cross-border B2B payments. Export driven Germany now wants to introduce a compatible domestic B2B-e-invoice (CTC) system earlier and, as preparatory measure, edicted a law to already require it's economy to abolishes paper and PDF for domestic B2B invoices between 2025–2028.

B2G E-Invoices in Europe

After it's 2005 introduction of mandatory electronic-only invoices to their authorities, Denmark reported annual administrative savings of around 100mio€. Sweden followed 2008, Spain and Finland 2010, and in 2014 the EU requested all member countries to at least accept electronic invoices by 2020 in it's 2014/55 EU directive, for which an according standard, EN16931, was released.

This standard defines the calculation and rounding rules for those invoices in it's first part, EN16931–1, that and why, apart from EDI, only two XML formats, Cross Industry Invoice (CII) and Universal Business Language (UBL) are eligible in it's second part, EN16931–2. Parts 3–5 can be bought, they e.g. contain the mapping of the mandatory attributes to CII and UBL and define a way how national additional requirements could be expressed, so called core invoice usage specifications, CIUS for national extensions. One german CIUS is XRechnung, which e.g. defines that the postal address of the sender is required (due to the german VAT law): While it is possible to send an invoice to French authorities from e.g. IBM in Paris, an invoice to German authorities from IBM in Berlin requires the street address or a PO box.

For UBL and CII, calculation rules and codelists, i.e. the list of possible attributes, are identical. For the latter, even a central repository is being maintained, which tells you the unit code for „piece" is abbreviated as H87 or a hour is HUR. And a working group of the committee of the European Committee for Standardization, „CEN" has released means to automatically validate according XML files.

Upon introduction of these electronic invoices, some countries like Germany and France voluntarily even mandated paper invoices to been furthermore rejected and electronic invoices are acceptable as of 2020. In Germany that relates to all not defense related invoices to national authorities exceeding 1,000€. Due to german federalism, the introduction in „subcentral" entities, i.e. the states, is still ongoing, with e.g. the state of Hesse making it compulsory from April 18th, 2024. Few of german states, like Mecklenburg Vorpommern, may however continue allowing paper (or non-machine-readable electronic) invoices to authorities.

Background: What is a CTC

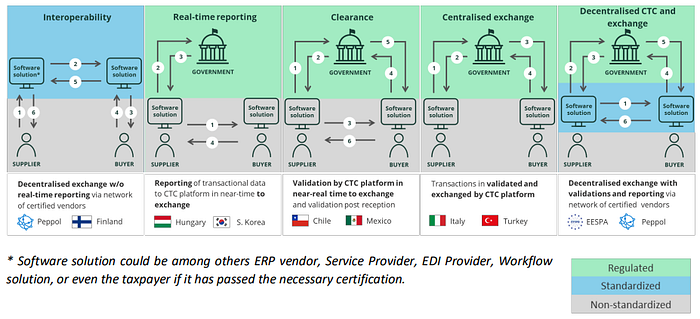

The reason for B2G E-Invoices are administrative savings, but that for B2B E-Invoices is to tax fraud. A Continous Transaction Control system (CTC, German „Umsatzsteuermeldesystem") may be used to combat VAT fraud because it sends copies of every invoice to the fiscal authorities in order for them to keep track of (VAT) tax debt. There are several models who sends this copy to whom, if agents are allowed, if a original has been sent to the recipient independently. Several other parameters, like the period in which it acceptable to send the copy to the IRS are usually defined separately.

A great overview can be found in Kollmann.

Types of CTC as defined by Kollmann. Italy uses model #4, Hungary #2, France a slight alteration of model 5. Paper invoices are only possible in #2 and #3.

Any approach requires at least parts, if not the whole invoice, to be machine understandable, indicating EDI, XML or hybrid invoices. A paper copy may still be sent to the recipient if it is not the original (i.e. the electronic version has already been sent) or if the CTC type provides only a digital token, like a ID or a signature, to the data, which is then printed on the paper invoice.

B2B E-Invoices in Europe

E-Invoices used to be optional (and used since 1958, that is) for companies. However, for their 2019 mandatorization, Italy introduced a proprietary format called FatturaPA and a central CTC model in 2019 with notable success.

2021 came Hungary with a different model (realtime reporting).

France already decided to follow with a model that will require e-invoices, partly similar to the Italian model but more adaptive and more based on EN16931 (e.g. with UBL and CII as eligible formats).

In the (french) „four corner" CTC-model the issuer sends his invoice to a service provider, who forwards it to another service provider the recipient is customer of. The sender and receiver service provider may be the same company but at least one of them will be oblidged to forward the data to the IRS, in France the so-called national platform.

The french approach requires all agents=platforms to archive and visualize the data for their users. They additionally allow direct connections to the free-of-charge national platform.

France worked a lot on all the details and talks about it, both internationally

as well as domestically

Additionally, the European Commission's legislative proposal on VAT in the Digital Age or ViDA initiative plans the introduction of cross border B2B e-invoices in it's second stage starting 2028.

B2B E-Invoices in Germany

Before 2000

With EDI around since 1958, the first global EDI standards were used in Germany around 1977.

The VAT law of 2002 required either EDI or digital signatures. This signature requirement was lifted in the EU prompted VAT simplification law in 2010. Afterwards PDF invoices became much more common.

Before 2010

One of the first global XML standards for invoices, Universal Business Language, emerged in 2005 and was also used in Germany.

Before 2020

The first version of consolidated requirements for digital invoicing and record keeping, the so-called GoBD were conceived on 2014–11–14.

The GoBD affect all businesses issuing or processing, e.g. paying, electronic digital invoices, they are still in effect to this day and also apply to companies forced to issue electronic invoices.

2014 saw the birth of a „hybrid" format, called ZUGFeRD, which consists of a human readble PDF file with embedded machine readable XML. ZUGFeRD embeds CII XML in human readable PDF files. Nowadays, the EN16931 compliant version 2 of the ZUGFeRD standard is called Factur-X 1. XML as well as ZUGFeRD/Factur-X were, just like plain PDF, of course always optional for all parties.

Before 2030

Soon after the 2019 introduction of B2B in Italy the first publications suggested it for Germany, soon the Federal Audit Office (Bundesrechnungshof) joined to the pledge, some research was conducted by the Parliament's Scientific Service and a political party, to be elected into the government particularly endorsed it. In 2021 the term CTC (Umsatzsteuermeldesystem) went into the coalition treaty with this party to be implemented „schnellstmöglichst" (as soon as possible). The ministry of finance issues a draft law, the Growth Opportunities Act, to, among others, make the neccessary adjustments to the VAT law .

This draft law includes small change to the VAT law (Umsatzsteuergesetz). First of all the e-invoice definition changed from any electronic invoice to structured, i.e. machine readable, ones. Secondly it requires structured e-invoices to be issued 6 month at the latest after the performance of the service (matching the current paper requirement).

Since that changes the market of a European country, attemps to introduce mandatory B2B e-invoicing have to be requested. Those exemptions were granted to Italy and France and has now also been requested for Germany in November 2022 and was granted in 2023.

Additionally, already this first draft law had to involve the stakeholders, so a questionaire was sent to all affected professional associations about a possible introduction in 2025. One of the public replies calls 2025 too soon, requests at least one year to implement after the publication of final details. Less than half of the replies seem to have commented on e-invoicing at all, and ten of 16 requested the inclusion of hybrid invoices, i.e. XML embedded in PDF, like Factur-X. This request was granted under the condition that the XML part be used.

Interestingly, given the scarcity of specialized XML readers (like this one), hybrid invoices seem to be the only way to send invoices if you don't know if you are dealing with a private or a business customer.

After the first draft is from the ministry ("Referentenentwurf"), the second draft, approved by the government ("Regierungsentwurf"), was published 2023–08–29, and on page 67 it foresees 2025 as kind of transition period so that B2B invoices have to be send as electronic invoices (pg 66), which means in UBL or Cross Industry Invoice XML (or EDIFACT, only those are EN16931 compliant, pg 65f) as of January 1st, 2027, in certain cases 2028.

The law has been passed by both the Federal Parliament (Bundestag) and Federal Council (Bundesrat) in March 2024.

Obligations

Companies are required to be able to read and process UBL, CII and Factur-X invoices as of January 1st, 2025 and have to write them as of January 1st, 2027, 2028 if you are a small company. Andreas Pelekies (validool.org) summarized the schedule as follows:

This implies that the german special regulations on digital accounting (GoBD) now de facto apply to all companies.

Conclusion

No conclusion. That's where we are now. We're talking about 1.2bn invoices/year, the according Unit Code is "HTZ": Hertz. 38 Hertz to be more precise.

The text and the Author

This text was published 2023–08–24 under the public domain, CC0, by some german guy called Jochen Stärk, who occasionally publishes open source for electronic invoices (orders etc.) in his spare time. Fundamentally he is against mandatory E-Invoicing, he would rather like to see more people doing electronic invoices, in particular hybrid ones, voluntarily, because it "really makes sense".

It was amended on

- 2023–09–02 to reflect the updates of the second draft in the last paragraph of the introduction and in the last paragraph before the conclusion, in particular the move to 2026. The sentence about the law temporalily being stalled was removed from the conclusion.

- 2024–01–15, with the two sentences on the current status with the link to versions and timeline being added, and again on 2024–01–30, with a corrected rejection year from 2024 to 2023 and the date added when the mediation committee will meet in February.

- 2024–03–22 when the Federal Council (Bundesrat) passed the law: the obligation to send was corrected to 2027/2028.

- 2024–04–12 with amendments to introduction, conclusion, where a link was added to the timeline of the law, to a viewer, the rest of the public replies and the verdict that hybrid invoices are eligible, the "obligations" section got it's heading and a calrification and where a single incorrect occurence of "2026" was corrected to "2025".

Questions, corrections, comments? jstaerk@usegroup.de