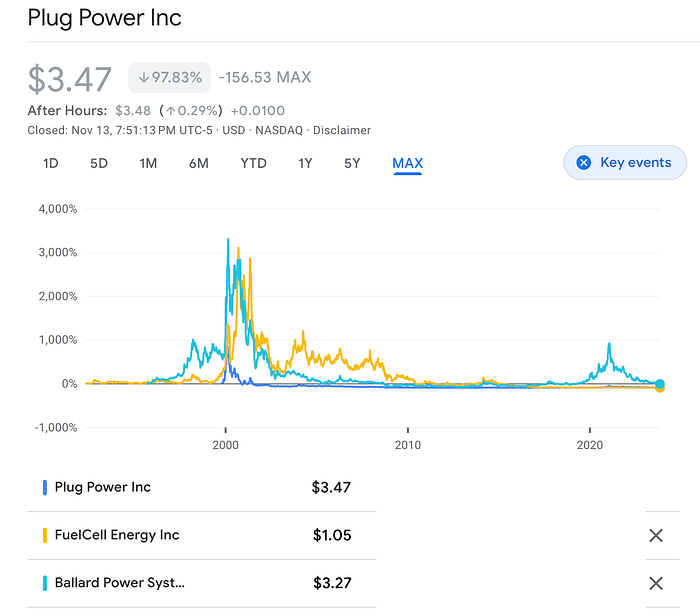

There are three long running supporting cast members in stagings of the sad farce that is trials of hydrogen for fleets, FuelCell Energy, Plug Power and Ballard Power Systems. All of their market capitalizations peaked roughly 99% above their current stock valuations in 2000. They've all participated in innumerable hydrogen fleet trials, yet none of the trials has resulted in hundreds or thousands of vehicles operating on hydrogen. Quite the opposite, most have resulted in hydrogen being abandoned entirely.

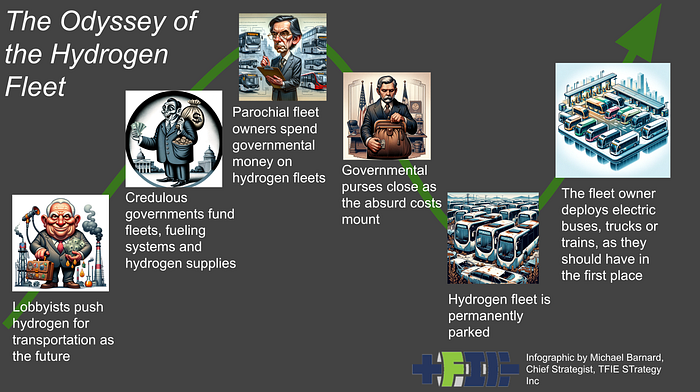

It was a sufficiently robust pattern that I had fun writing a notional, six-part play around the theme, the stages being so clear and the hydrogen chorus so pervasive early yet completely silent later. I've written a couple of articles on examples of the play being staged in Iceland, Canada, France, Germany, India, Austria and the USA, sometimes multiple times in a single country.

Today a publicist tried to interest me in a 'win' by one of the three firms, and that led me to ask "In addition to the Whistler, BC failure, where else have Ballard fuel cells been involved in failed trials since 2000"? The list is long. This is probably not an exhaustive list of their failures, but it does answer one question and beg another.

While 2000 is 24 years ago now, Ballard was formed long before that in 1979. Ironically, originally it was formed to research and find applications for lithium batteries, but abandoned that for fuel cells in 1989. Yes, Ballard is actually a 44 year old company that pivoted away from a technology that has come to dominate transportation and aspects of energy. It went public in 1993, making it a 30 year old publicly listed corporation.

It was a hot stock in the late 1990s, but peaked early 2000, and never remotely recovered. Yet it keeps limping on, never actually succeeding or being put out of its misery. So let's look at the litany of an absurd number of tiny trials that never led to successful growth.

In 2000, Ballard and the city of Chicago concluded a two year trial of three buses. Similarly, the City of Vancouver trial of three Ballard powered buses concluded that year. The City of Ottawa looked at those two trials and concluded that they were much more expensive, covered much less ground, had very high fuel costs, required constant maintenance and decided to ignore them. After trialing hydrogen buses, Chicago abandoned the idea, never trialed them again and is currently buying battery electric buses. Similarly, the City of Vancouver ignored hydrogen buses as well.

In 2001, Ballard concluded a hydrogen bus trial with the SunLine Transit Agency of Thousand Palms, CA, which serves Coachella, which might be telling. They naturally claimed it was a stunning success. The agency did too, but mostly because of the visibility it brought them. The final report has pages of parts replaced and road calls for a single bus for a single year. SunLine, having built a single hydrogen refueling station and existing in a state with an odd obsession with hydrogen, has continued to harvest governmental largesse to the tune of, most recently, $7,819,257, for hydrogen trials and upgrading the station. The fleet still has several fuel cell buses with Ballard fuel cells in them, making it possibly the longest lasting fleet. However, that last governmental grant was matched with equivalent funding to buy battery electric buses and install charging infrastructure, so it seems as if the Odyssey is entering its final stages.

The same year, Ballard also managed to convince a Japanese sewage plant to try it out, shipping a 250 kW fuel cell to be run off biomethane. By 2004 it was history.

In 2002, Coleman Powermate Inc launched a fuel cell generator incorporating Ballard's technology, per SEC filings by Ballard. The $8,000 USD device had sufficient juice to power a computer, phone, fax, and light for 8 to 10 hours before refueling, which is to say a ludicrously small amount of energy for a very expensive price. It sank without a trace, with no record of anyone buying a unit. Ballard bought a couple of tiny firms and Alstom's fuel cell business in 2002 as well.

2003 saw a trial of a Ballard fuel cell as an uninterruptible power supply (UPS). There's no indication that the UPS firm, MGE, bothered to move forward, and current MGE UPS devices don't have fuel cells.

That year also saw the launch of the London trial of three fuel cell buses, under the EU and UK government funded CUTE and HyFleet. Ballard claims this as a big win as London has expanded its total fleet of hydrogen buses to 20. Meanwhile, London has 8,600 buses and about a thousand of them are battery electric, with hundreds more battery electric buses on order from several vendors including BYD. The London trial is one of those limping along hydrogen 'success' stories that doesn't stand up to scrutiny as well, with the hydrogen fleet a rounding error compared to battery electric vehicles.

As the London transit organizations' own reports point out, there is 99% to 100% success rate covering routes with a combination of depot and opportunity charging along journeys for battery electric vehicles, with only a 92% success rate for routes with hydrogen buses which can only be fueled at depots. The report also points out that hydrogen buses are much more expensive to fuel and maintain than battery electric buses which are already at cost parity with diesel buses due to lower maintenance and fuel costs. They were also worse than diesel for CO2e emissions with hydrogen from steam reformation of natural gas, and of course worse than battery electric if electrolysis was used in any event. It's unclear why London persists with hydrogen when it has so clearly failed to deliver.

2005 saw delivery of five Ford cars with Ballard fuel cells in them to the BC government as part of a multi-year, $8.7 million trial of the vehicles. No final report on that trial seems to be available, and the government certainly doesn't have a fleet of fuel cell cars today. Sank without a trace, taking the millions with it.

Also in 2005, Ballard delivered the first fuel cells for forklifts which eventually ended up in Walmart distribution centers, where there is a tiny amount of merit in their use in indoor spaces to displace natural gas, diesel and lead acid battery forklifts. Early deployments of forklifts in Walmart and other distribution centers were funded by the US DOE to the tune of about $1.3 million per forklift. There are about 40,000 hydrogen fuel cell forklifts in operation compared to 1.3 million battery electric and 800,000 internal combustion forklifts sold in 2021 alone globally.

Hydrogen fuel cell forklifts remain a rounding error niche that's heavily promoted by the US DOE as a big win in their hydrogen for energy presentations, although they are spending less direct money on them now. It's worth noting that the hydrogen for the few forklifts in operation is black or gray hydrogen, not green hydrogen. Other countries have a few hundred here and there. Toyota, US firm Hyster and Hyundai have offerings, but the Toyota and Hyundai ones are mostly demonstration units, with South Korea deploying one test unit this year.

While touted as a big hydrogen win, the reality is that the forklift market has chosen lithium ion batteries as the energy carrier of the future and hydrogen forklifts exist only in legacy firms which were initially funded by the US DOE or governmental agencies in Europe, Japan or South Korea.

In 2006, Ballard managed to sell more fuel cells for forklifts. It's worth noting that it sold them to General Hydrogen of BC, which was also founded by Ballard co-founders, so undoubtedly both firms claimed a big win instead of a little family trade of money.

In 2007, Ballard sold its automotive fuel cell division and assets to Daimler and Ford. Daimler took that and has managed to lease 60 entire cars to people on three continents since. Ford built 30 entire cars with fuel cells. Neither commercialized fuel cell cars.

In 2008, Ballard signed a deal with North America's largest bus manufacturer, New Flyer, to be the exclusive supplier of fuel cells for a proposed line of hydrogen powered shuttle buses. There's no evidence New Flyer introduced that product.

Also that year, Ballard signed a deal with Plug Power — note stock price chart above — for more fuel cells for forklift power trains Plug Power was selling.

In 2009, Ballard introduced fuel cell back up systems for telecommunications. They still list the product on their site, but have no customer testimonials or references. Presumably they've sold a few here and there, with one announcement about a sale in India, sufficient to keep the product limping along. The UPS market is dominated by lithium ion batteries of course, with fuel cell UPS' being a rounding error.

In 2010, Ballard fuel cells were put, with great fanfare, in 20 buses in Whistler for the 2010 Winter Olympics. The hydrogen was at least 'green', in that it was made with hydroelectricity, but unfortunately that was Quebec hydro and the hydrogen was trucked across the country in 9,000 km round trip journeys, with each truck load likely enabling about 10,000 km of bus journey. The bus fleet, in addition to very expensive hydrogen, had innumerable problems including freezing in the relatively mild Whistler winters, and hydrogen was abandoned entirely for buses in the province.

In 2011, Ballard provided five fuel cell modules for a hydrogen bus trial in Norway. Those buses managed to make it into service in 2013, operated for a couple of years and were abandoned. Oslo is acquiring hundreds of electric buses with the target of being fully battery electric by the end of 2023, something that they almost achieved.

In 2012, Ballard sold a fuel cell power system to Toyota's California sales and marketing headquarters. California, of course, paid for it. There is no public record of any other sales, although they were delivering a few fuel cells to Norway and London based on previous sales, and presumably trying to keep the Whistler buses operating.

It also bought a small backup system company, Idatec, which turned methanol into hydrogen for use in fuel cells. Methanol, of course, is a wood alcohol made entirely from fossil fuels with each kilogram of methanol having a carbon debt of two kilograms of CO2, on average. By stripping the carbon out of the methanol, more CO2 is emitted as well as throwing away 45% of the energy in the liquid and then putting it through a fuel cell which is 50% efficient. Methanol to hydrogen to fuel cells is a completely non-virtuous pathway that's higher emissions than just burning diesel in generators, as well as being much more expensive.

In 2013, Ballard claimed the 500th sale of its methanol to hydrogen to fuel cell product, based on Idatec's previous sales.

Also that year, Ballard announced a deal to supply Volkswagen with fuel cells for its hydrogen HyMotion demonstrators, something VW had been showing off at trade shows globally for years. VW never introduced a hydrogen fuel cell car for sale or lease, and clearly stated this year that they would never do so.

In 2014, Ballard renewed its Plug Power forklift deal.

They also announced that they would be powering 27 hydrogen buses manufactured by European bus firm Van Hool. The five abandoned Oslo buses were among them. Cologne in Germany had two, and Cologne remains an odd holdout for hydrogen buses, with 52 of them from different manufacturers. Of course, Cologne is in Germany's industrial heartland with many automotive and petrochemical firms, so has a strong predisposition locally to molecules for energy. It's going to be one of the leave behind regions unless it gets its head out of hydrogen for everything. All of Cologne's buses have Ballard fuel cells in them, so 52 fuel cells in a decade makes them one of the firm's biggest customers.

San Remo, Italy picked up five buses, funded by the government through FCH-JU under grand agreement 278192. Of course, San Remo realized the folly of its ways and is revamping its electric trolley buses with new battery electric buses. There's no evidence that the hydrogen buses are still in operation.

Flanders, Belgium picked up five of the buses. Of course, it's just down the road from the Van Hool headquarters in Koningshooikt. Despite that, the Flanders transit agency De Lijn is very clear on its website that all buses and trams will be battery electric or running on overhead wires, with nary a mention of hydrogen.

Finally, Aberdeen, Scotland was to have received 10 hydrogen buses with Ballard fuel cells. As a reminder, Aberdeen is a major North Sea fossil fuel industrial hub, although it's struggling through the low-carbon transition with extensive offshore wind work and a lot of people hoping desperately for both undersea carbon capture and more gas exploration. Big on molecules for energy, in other words, although with a bunch of people, including many I've spoken with in the past couple of years, working on the transition.

What that means is lots of governmental funding for hydrogen bus dead ends. Although it looks as if the Van Hool hydrogen buses are long gone, the Aberdeen transit organization still has 25 double decker hydrogen buses manufactured by Irish firm Wright Buses. Of course, it also has 24 electric buses, and the hydrogen buses are running on gray hydrogen. Once more expensive low-carbon hydrogen is required and governmental money runs out, the hydrogen fleet will be mothballed. That's just a matter of time. For now, the fuel cells in Aberdeen's buses still seem to be coming from Ballard, making it Ballard's second biggest customer up until this point.

From 27 hydrogen buses with Ballard fuel cells to 77 buses in only 11 years. Meanwhile, there thousands of electric buses being delivered in Europe each year. Ballard's European fuel cell buses remain a rounding error.

In 2015, Ballard inked a deal for another single MW power system to be installed at a sodium chlorate chemical plant in Bordeaux, France which generates hydrogen as a by product of its chemical processes. Naturally the tab was picked up by the government and a French hydrogen production concern. The firm which took the fuel cell, AkzoNobel had done this before in 2005, and has its own fuel cell firm, Nedstack, so it's not looking like a solid win for Ballard.

The big news for 2015 was the 300 bus deal in China, with Ballard's cut being worth $17 million. Many of the buses were for the city of Foshan, population 8 million and a place which chose a very direct strategic pathway for hydrogen. They have 1,000 hydrogen fuel cell buses on their roads now apparently, but had announced plans for 2,441 electric buses. Having fuel cell buses and now a light tram as well makes Foshan a deep outlier in China, as 89% of bus purchases are battery electric and about 600,000 battery electric buses drive silently its streets. Of course, the hydrogen wasn't green, but at least some of it was blue.

Are these 1,000 buses the start of a major ramp up for Ballard? No, China is of course developing and deploying its own proprietary fuel cell technologies in buses now. As there are under 10,000 registered fuel cell vehicles in the entire country, and 1,000 of them are the buses in Foshan, this looks a lot more like an industrial export policy to naive buyers than a transit policy to me.

In 2016, China was in Ballard's news stream again, with a joint venture for a Chinese firm to manufacture and sell Ballard's backup systems in that country, in other words a licensing agreement, not a growth agreement. And there was a distribution agreement with a Toyota subsidiary for Japan. Not an exciting year.

In 2017, Ballard closed another licensing deal with a Chinese manufacturer, Broad-Ocean Motor Company, to manufacture and sell their fuel cell motors. Of course, that was the year that Broad-Ocean became Ballard's large stock holder as well, almost 10%. They also delivered another handful of bus fuel cells to SunLine in California.

In 2018, Ballard's Chinese licensee announced a deal for 500 3-ton trucks to be deployed in China. Of course, there are currently over 500,000 battery electric trucks in China, and as noted under 10,000 registered fuel cell vehicles in the country right now, so this is still rounding error territory.

They also sold a few more fuel cells for forklifts, this time through a firm which integrates their fuel cells into drive trains for fork lifts and at Daimler Alabama plant. Of course, US DOE funding was involved.

In 2019, trying desperately to create a fuel cell car market where none exists, Ballard arranged for several employees to lease Toyota Mirai cars in BC.

Working with the same French hydrogen supplier, Ballard announced they were developing a power station for French Guiana, converting wind and solar energy into hydrogen and then back into much less electricity in an electricity-destroying loop at great expense. Four years later, it's still not operational and apparently the locals want it not to be built.

In Alberta, Ballard received part of the US$11.2 million of governmental largesse for two hydrogen powered semi trucks. They are expected to enter some semblance of service in 2024, five years after the deal was announced, still funded by governmental money.

Also that year, Ballard signed a deal to provide some fuel cells for a firm which makes mining equipment, First Mode, which would install them in vehicles in their proving grounds. This year First Mode completed its year of testing of a single truck, just in time for mining giant BHP, Rio Tinto and Fortescue to announce that hydrogen had no place in mining and that decarbonized mines would be battery electric.

Ballard became part of H2Ports in Europe, an organization vainly trying to get ports to decarbonize with fuel cell vehicles. Of course, this year industry giant A.P. Moller Maersk subdivision APM Terminals, which runs 8% of the world's ports, published their white paper with total cost of ownership for battery electric vs hydrogen that makes it clear that that entire segment will be ignoring hydrogen too.

Finally, Ballard announced a deal with ABB's marine division to develop a hydrogen fuel cell tug boat in France. As of 2022, there was a design concept and there is no indication that a hull has hit water. ABB does seem to be involved in a lot of attempts to put hydrogen in ships, but all inland shipping and port service boats are just electrifying. As an example, China has two 700 unit container ships plying 1,000 km routes on the Yangtze, powered by batteries in containers that are winched on and off to charge, and Europe has a smaller container ship with a similar model. Lots of electrification going on in reality, and very little hydrogen.

In 2020, Ballard firmed up a memorandum of understanding with Audi, and delivered no fuel cells under that agreement as far as I could tell.

Also, in another fit of governmental largesse, Norway funded retrofitting of an excavator with a Ballard fuel cell for trials. Meanwhile, pretty much every manufacturer is bringing battery electric construction equipment to market.

In 2021, Ballard re-announced the French Guiana project which is going nowhere. They also received an order for one (1) 200 kW fuel cell from a hydrogen project at an ammonia plant in Portugal. When you are pushing press releases for a single tiny fuel cell order, there's a problem.

With more governmental largesse, Ballard is going to work with Microsoft and Caterpillar on a data center backup system demonstrator, funded by the US DOE under the H2Scale Initiative with NREL Lab support.

Ballard also signed a deal with Canadian Pacific Railroad to provide a couple of fuel cells for a hydrogen powered locomotive trial, something that's dead in the water as all rail will electrify with grid ties and batteries, as is occurring everywhere in the world already with the lagging exception of North America.

Late in the year, the ever optimistic hydrogen booster H2-International blog boldly announced "Ballard Power — 2022 will be the year of the breakthrough".

In 2022, Ballard lost a record $173.5 million on revenues of $83.8 million.

The firm also agreed to provide a single power unit for a single demonstration freight truck for Chinese firm Wisdom, which would supply the truck to Pepsi in Australia. It hasn't entered service yet. The presence of Queensland State Minister for Energy, Renewables and Hydrogen, Mick de Brenni, at a testing press conference suggests that governmental money is on the table there as well.

The firm made the startling claim that "The company's technology is now used in more than 1,400 transit buses and 2,300 trucks, in addition to trains and ships" in its ESG report. Given the small numbers of trials, the small numbers of vehicles in the trials and the failure of so many trials, those numbers appear inflated. But taking them at face value, after 44 years, the firm has managed to get their technology into only 3,700 trucks and buses.

Once again, rounding error numbers compared to the three million buses on the roads of the world's cities and the roughly 335 million commercial vehicles on roads. And it's a rounding error compared to the number of battery electric vehicles of all types.

With that claim comes the even more remarkable claim that Ballard powered vehicles resulted in "53 million fewer US gallons (200 million liters) of diesel in 2022, avoiding about 540,000 tonnes of carbon dioxide". The first part, sure, but the carbon dioxide? As this timeline shows, virtually all of the hydrogen that's put through Ballard's fuel cells globally is gray hydrogen, and the one instance of green hydrogen in Whistler trucked the hydrogen across the country with diesel.

Let's just start with 200 million liters of diesel. Each liter emits about 2.7 kilograms of CO2, so 200 million of them indeed would emit about 540,000 tons of CO2. But when the hydrogen is made from natural gas, ever kilogram comes with a carbon debt of about 11 kilograms of CO2e between upstream leakage and steam reformation.

A kilogram of hydrogen has about as much energy as a gallon of diesel, but fuel cells are more efficient, so let's call it 30 million kilograms of hydrogen. Multiply that by 11 kilograms and actual emissions are about 330 thousand tons instead of 540 thousand tons, or about 60% of diesel emissions. Sure, fuel cell vehicles don't emit particulates and noxious chemicals, so that's better for buses, but hydrogen fuel cells run on either gray hydrogen or electrolysed hydrogen will always have higher or much CO2 emissions than just using batteries. This, by the way, is a rough estimate, and the London report on their hydrogen fleet actually pegged full lifecycle emissions higher for hydrogen with steam reformation of natural gas than for diesel.

Also, Canadian Pacific continued down the dead end hydrogen fuel cell locomotive route with a few more orders and a couple of dozen more bus orders came in for Europe, this time for Poland which apparently hasn't looked around at what everybody else is doing. Oh, wait, there are already approaching a thousand electric buses operating in that country. Once again, Ballard's fuel cell is a rounding error.

One more thing on those Polish fuel cell buses. They are by Solaris, which is a Polish bus manufacturer that's been wasting some of its time and money on fuel cells while selling vastly more electric buses. It's completely unclear why as late as 2022 the tiny city of Wałbrzych is interested in wasting what little money it has on hydrogen buses instead of cheaper, more effective electric ones, but irrational behavior does persist despite overwhelming empirical evidence that everyone else is going battery electric.

And so, 2023 rolls around. 170 more fuel cells for Solaris in Poland. Another 60 fuel cells for First Mode for mining equipment that won't sell well.

And Ford is back at the hydrogen table, this time with the thought that they'll develop hydrogen heavy duty trucks, not having paid attention to the global battery truck dominance, the stellar electric truck results from NACFE's Run on Less 2023 assessment, but definitely looking to spend some of the US$77 million the US DOE gave to them, GM and Chrysler to develop hydrogen trucks, in contravention of all the basics of common sense.

And so that's the 44 year history of this perpetual chaser of governmental money. Virtually entirely failed initiatives that don't really reduce carbon emissions. Rounding error numbers of power trains for vehicles, a lot of which are mothballed permanently.

Just for fun, I went through Ballard's annual results from 2000 to 2022 inclusive. Over those 23 years, they've recorded $1.3 billion in net losses, an average of $55 million per year.

Peak valuation in March 2000. 2.6% of that market valuation today. A decades long history of average $55 million annual losses. A history of scraping by on governmental grant programs. A history that included pivoting away from lithium batteries to fuel cells. A history of persisting with fuel cells even as globally in every niche fuel cells fail miserably compared to batteries and grid ties. What exactly is the Board of Directors doing?