Climate.

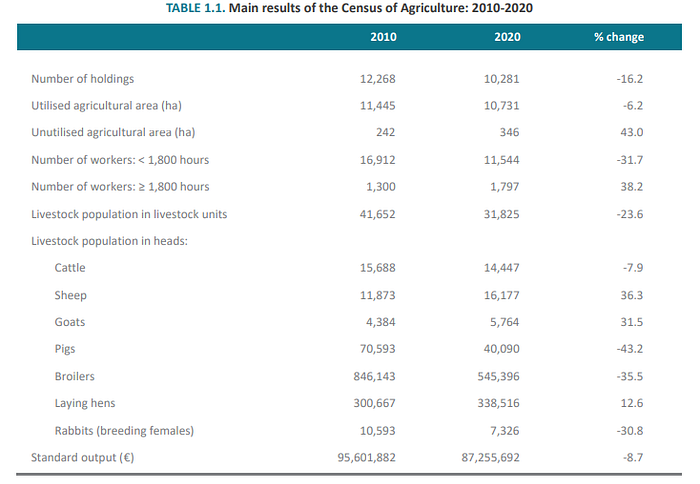

Imagine residing on an island barely 26km by 12km, shared with 520,000 local inhabitants and almost 3 million visiting tourists every year. This is on an arid land that can naturally only support about 30,000 people. If that sounds unsustainable, it's because it is. This shortfall is worsening as the population grows, and agricultural production continues to decline.

That island is Malta, and to compensate our shortfall here, we import 90% of all our needs, including food, leaving it particularly vulnerable to overseas market changes. The recent surge in inflation, primarily triggered by post-pandemic disruptions and the war in Ukraine, has presented considerable challenges for many countries including Malta.

Only recently have prices begun to stabilize, making the weekly shop a more predictable affair, which is a relief for many. Unfortunately, a constant sense of dread remains, fearing that the inflation beast may return, possibly sooner and hungrier than before.

In January 2024, an upcoming EU-wide carbon tax on shipping is anticipated to have significant repercussions for European consumers, not least those of us in Malta.

This impending tax is poised to increase the costs of shipped imports and exports, representing a noteworthy development as the European Union extends the scope of its CO2 emissions trading scheme (ETS) to include shipping companies. Malta being an island nation, heavily reliant on shipping for its trade connections, is expected to experience distinctive challenges. So the new ETS regime has consequences.

What are Emissions Trading Systems?

Emissions trading systems (ETS) are market-based approaches designed to reduce greenhouse gas emissions. The basic premise of an emissions trading system is to create a financial incentive for industries to limit their greenhouse gas emissions.

Emissions trading systems typically work in the following way:

- Cap Setting: The government or a regulatory body sets an overall cap on the total amount of greenhouse gas emissions allowed within a specific jurisdiction. This cap is usually established to align with emission reduction targets.

- Allowance Allocation: Under the cap, the government issues a certain number of emission allowances, each representing the right to emit a specific amount of greenhouse gases. These allowances can be distributed through different methods, including auctions, free allocation to existing emitters, or a combination of both.

- Trading: Emitters subject to the cap can buy and sell allowances among themselves. If a company reduces its emissions and has surplus allowances, it can sell them to another company that exceeds its allocated emissions and needs additional allowances to comply.

- Compliance: Periodically, companies must surrender enough allowances to cover their actual emissions. Those unable to do so may face penalties or fines.

- Market Dynamics: The trading of allowances creates a market price for emissions, providing a financial incentive for companies to reduce their greenhouse gas emissions. This incentivizes the adoption of cleaner technologies and practices.

- Flexibility and Innovation: ETS allows for flexibility in meeting emissions reduction targets. Companies can either invest in emission reduction measures or purchase allowances to comply. This flexibility encourages innovation in emission reduction technologies and practices.

The European Union isn't the only region with an ETS in place. Several regions and countries around the world have implemented or are considering implementing their own.

Different regional Emissions Trading Systems operate better when they are integrated. However, this involves tackling a comprehensive array of organizational, legal, political, and social hurdles. These challenges can be effectively navigated by enhancing transparency and collaboration among regulators

It's important to note that the effectiveness of emissions trading systems depends on various factors, including the stringency of the emissions cap, the accuracy of emissions monitoring and reporting, and the overall enforcement of regulations.

Historical Precedent.

The idea of emissions trading systems is not a recent development; it took shape in the 1970s and 1980s. Among the earliest and most notable instances is the sulfur dioxide (SO2) trading program implemented in the United States.

The U.S. Acid Rain Program, established as part of the Clean Air Act Amendments in 1990, imposes a persistent restriction on the total allowable SO2 emissions from electric generating units throughout the United States. This initiative was introduced gradually, leading to the establishment of a permanent 'cap' of 8.95 million tons for SO2 emissions by the year 2010. Notably, this cap represents about half of the emissions documented from the power sector in 1980.

Often regarded as a successful model of emissions trading, the Acid Rain Program achieved substantial reductions in emissions at a lower cost compared to traditional command-and-control regulations

The European Union's Emissions Trading System.

Established in 2005, the European Union Emissions Trading System (EU ETS) serves as a fundamental element in the EU's strategy to address climate change, acting as a pivotal instrument for efficiently curbing greenhouse gas emissions.

Formulated as part of the EU's commitment to achieving Kyoto Protocol targets for greenhouse gas reductions, the EU ETS encompasses emissions from sectors like power generation, industry, and aviation. Initially centred on carbon dioxide (CO2) emissions, the system will evolve to include methane (CH4) and nitrous oxide (N2O) from specific sectors, starting in 2026.

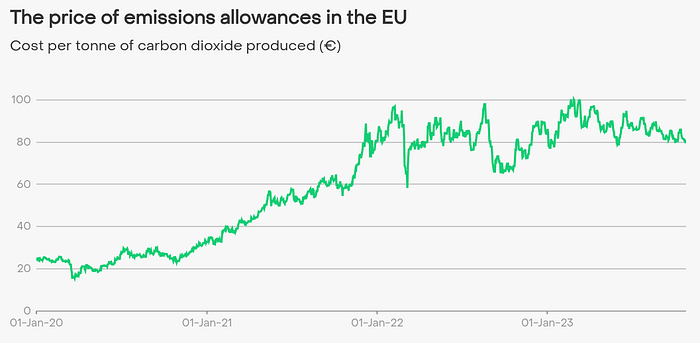

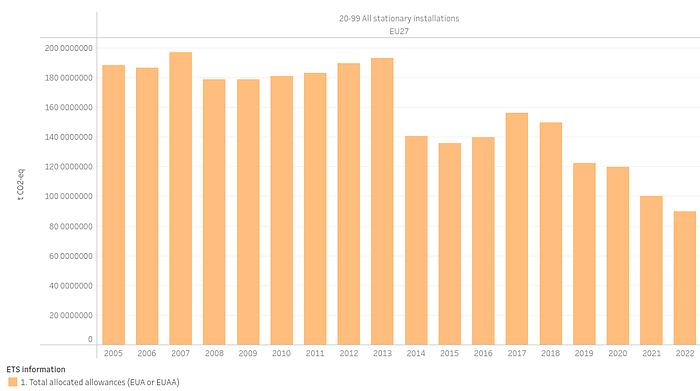

The overall volume of greenhouse gases that can be emitted by power plants, industry factories and the aviation sector covered by the EU Emissions Trading System is limited by a cap set by the European Commission on the number of emission allowances. Within the cap, companies receive or buy emission allowances, which they can trade as needed on the secondary market (an ETS is also known as a 'cap and trade scheme'). Crucially the cap decreases every year, meaning that the price of such allowances tends to increase, ensuring that total emissions fall.

Each allowance gives the holder the right to emit:

- one tonne of carbon dioxide (CO2), or

- the equivalent amount of other powerful greenhouse gases, nitrous oxide (N2O) and perfluorocarbons (PFCs).

The average auction price in 2022 for 1 tonne of CO2 emissions was €78.91 whilst the average secondary market price was €80.82.

The EU ETS was planned over 4 phases. The first phase served as a pilot phase with a focus on assessing the feasibility of emissions trading. The scope of the second phase was to refine the allocation process and to harmonize the system across member states. The final two stages involve the decrease in allowances to meet the EU's goals of reducing emissions.

Phase 3 of the EU ETS (2013–2020) saw the Union-wide cap for stationary installations decrease each year by a linear reduction factor of 1.74%.

Phase 4 of the EU ETS (2021–2030) saw the cap on emissions continue to decrease annually at an increased annual linear reduction factor of 2.2%

As the EU sets ambitious climate targets, the EU ETS remains a key instrument, subject to periodic reviews and updates to align with evolving climate goals and enhance its efficacy in emissions reduction. The EU envisions ongoing reforms and strengthening measures for the EU ETS to contribute significantly to its broader climate objectives, including the pursuit of carbon neutrality by 2050.

This is where things get tough for Malta. As part of the EU's amended Nationally Determined Contributions for this year's global stocktake exercise which falls under the scope of COP 28, the EU's Emissions Trading System (EU ETS) is set to broaden by incorporating CO2 emissions from all large ships (5,000 gross tonnage and above) upon entry into EU ports, irrespective of their flag.

The coverage will encompass 50% of emissions from voyages commencing or concluding outside the EU, allowing third countries to determine appropriate actions for the remaining share. It also includes 100% of emissions occurring between two EU ports and when ships are within EU ports.

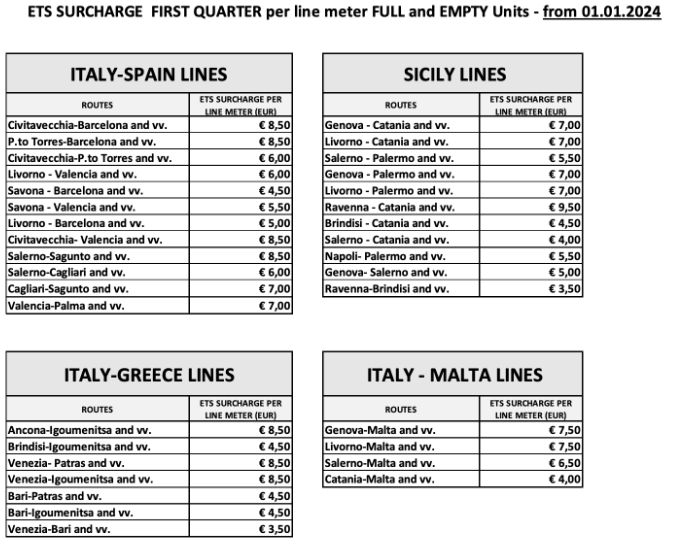

Being an island and highly dependent on imports through shipping, Maltese consumers are expected to bear the brunt of this enlargement in scope of the EU ETS. The transportation expense for a trailer originating from central Europe and taking the Genoa-Malta cargo route presently stands at approximately €3,500.

This cost is anticipated to rise by approximately 3% due to the implementation of the ETS surcharge. Furthermore, the introduction of road toll charges in Germany and other EU countries in the upcoming months may lead to an additional 3% increase in the freight cost for the same route.

To facilitate a seamless transition, shipping companies are initially required to surrender allowances for a portion of their emissions during a phased-in period:

- 2025: 40% of their emissions reported in 2024;

- 2026: 70% of their emissions reported in 2025;

- 2027 onwards: 100% of their reported emissions.

Despite the inflationary pressures that the broadening of the EU ETS will cause, the President of the European Commission, Ursula Von Der Leyen very recently emphasized the importance of such a system for the EU's climate goals during the opening addresses at COP 28, stating that,

"Carbon pricing is the centerpiece of the European Green Deal. In the European Union, if you pollute, you have to pay a price for that. If you want to avoid paying that price, you innovate and invest in clean technologies. And it works,"

As the EU ETS undergoes expansion, there are foreseeable economic consequences which are highlighted by the case of increased shipping costs for countries like Malta. The option of not introducing such a scheme might seem easier at first but the cost of an environmental disaster will be many times higher.

To mitigate the imminent higher costs, the Maltese government must be creative. Besides the obvious solution of increasing local produce and reducing the reliance on shipped goods, other incentives, such as funding for wind-assisted propulsion research and implementation, could be explored.

The proximity of Malta to Sicily, from where most food shipments originate, and the relatively small size of the Maltese population may imply that fully sail-driven boats, similar to Schooners like the Apollonia, could contribute to carbon-free food importation needs.

Port charges could be reduced for vessels with lower emissions to provide additional incentives for their usage. Furthermore, Malta could leverage its extensive ship registry, which ranks among the top 10 largest globally, to advocate for carriers to embrace more stringent emissions regulations and upgrade to newer, less polluting fleets.

In navigating the complexities of emissions trading systems and their economic implications, the global community faces a choice: bear the costs of proactive measures like the EU ETS or contend with the potentially greater and more catastrophic impacts of unmitigated climate change. The ongoing commitment to strengthening and refining the EU ETS highlights the potential for market-based approaches to drive positive environmental outcomes.

In essence, addressing the twin challenges of inflation and climate change requires a delicate balance and a comprehensive, collaborative effort. The journey toward sustainability necessitates continuous adaptation, transparency, and global cooperation to ensure a resilient and prosperous future for all.

If you found this article interesting, please subscribe: https://medium.com/@pedroborges01/subscribe

Sources: Malta NSO, MTA, Census of Agriculture 2020, MaltaToday, European Commission, Eurostat, U.S.EPA, E.U.NDC update, EEA, ESA, Ember Climate, ICAP, BBC, EUI. Read more about Nationally Determined Contributions and their relevance to COP 28 here: https://medium.com/the-new-climate/cop28-the-global-stocktake-956d18a0bd4a