In the thirty years since the IPCC released its first report in 1990, humanity has spewed more carbon dioxide into the atmosphere than the rest of human history combined. Even though there have been 28 COPs and countless local, national, and international political commitments and recommitments to carbon neutrality since then, we as a species have failed to make a dent in the curve of exponentially increasing emissions.

In the race to appear to be meeting international climate commitments while continuing to abide by economic growth — the sacred principle which cannot seem to be sacrificed no matter what the cost — one idea has risen to prominence as a nostrum for solving the climate crisis: carbon financing.

With this remedy, governments do not have to ruffle private industry feathers too much and can simply let 'market forces' do the work of shifting society to a low-carbon economic pathway, while once again not having to question the sanity of pursuing perpetual economic growth on a planet with finite resources.

So what is carbon pricing?

According to the World Bank:

"Carbon pricing is an instrument that captures the external costs of greenhouse gas (GHG) emissions — the costs of emissions that the public pays for, such as damage to crops, health care costs from heat waves and droughts, and loss of property from flooding and sea level rise — and ties them to their sources through a price, usually in the form of a price on the carbon dioxide (CO2) emitted."

There are two tried and true forms of carbon pricing: emissions trading systems (ETS) and carbon taxes. An ETS manages pollution by setting a cap on total annual emissions, often enforced by a governing body, that polluting entities must comply with. If a company, facility or other responsible entity outperforms the cap, they can trade the remainder of their share to one that cannot reduce their emissions enough to comply with the cap.

Most countries that have a state-managed cap and trade system have set their caps to decrease with time, forcing the economy as a whole to pre-emptively pursue less carbon intensive ways of operating. Carbon taxes, on the other hand, are imposed by a governing body on CO2 emissions or fossil fuel sales. Both kinds of carbon finance are good for different things. An ETS provides certainty about the amount of carbon emissions, but the price remains flexible, while a carbon tax guarantees the carbon price against an uncertain outcome.

Voluntary and Compliance Carbon Markets

There is a third kind of carbon pricing that has seen growing interest in the last couple years: carbon offsets. Working in tandem with an emissions trading system, carbon offsets allow a polluting entity to meet an emissions cap not by purchasing an allowance from another industry that has better performance, but rather by purchasing a share of a project that has met certain criteria to show that it actively removes carbon dioxide from the atmosphere or prevents greenhouse gasses from being emitted that otherwise would have been.

In other words, carbon offsets can serve as an alternative mechanism to direct emissions reductions when those reductions are implausible. A few countries have co opted the carbon market in support of their own climate mitigation goals and requirements, and the private sector has seen the exponential growth of project developers, third party verifiers, and registries in the past two decades. Subsequently to the Kyoto Protocol establishing the first international pseudo-compliance market called the Clean Development Mechanism, the sector has seen a split into two unique markets, with their own strengths and hindrances: the compliance carbon market and the voluntary one.

In either market, the projects representing the emission reductions are typically privately held and managed, as are the buyers; the difference is that in a compliance market, carbon offsets are purchased in order to comply with mandates rather than simply to increase marketability, and a regulatory body manages the credits. The dynamic between the private carbon market and the public sector is an interesting one, as the former can become an obstacle to more climate mitigation initiatives in the latter, a paradox I will get more into later.

Canada's Carbon Pricing Mechanisms

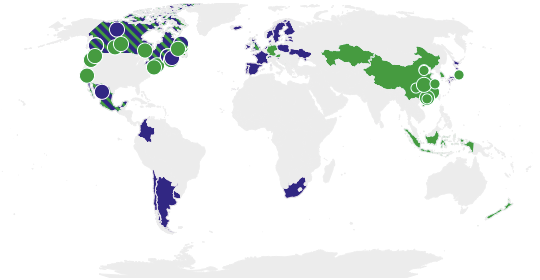

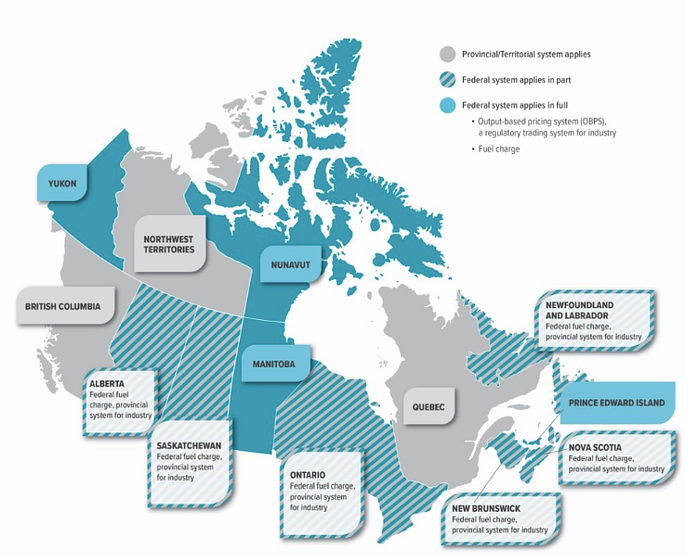

To finally introduce this article's title, few countries have been more ambitious in implementing these carbon pricing schemes than Canada. Six out of ten Canadian Provinces have an emissions trading scheme in place, and carbon pricing of some kind is in effect in all of Canada's provinces and territories and has been since 2019. Canada is the only country in the world to have implemented both a carbon tax (which they call a fuel charge) and a national cap-and-trade system. Their system is called the Output-Based Pricing System (OBPS) and proceeds generated from excess emissions charges are reinvested into the province or territory they came from to support cleaner industrial technologies and processes.

The federal OBPS is designed to ensure there is a price incentive for industrial emitters to reduce their greenhouse gas emissions and spur innovation while maintaining competitiveness and protecting against "carbon leakage" (i.e. the risk of industrial facilities moving from one region to another to avoid paying a price on carbon pollution). Participation is mandatory for facilities producing over 50 kilotonnes of CO2 per year and engaging in a Schedule 1 activity; other facilities can choose to opt in.

But Canada is going even further. In June of 2022, the country introduced its first greenhouse gas offset program. The Federal Greenhouse Gas Offset System encourages domestic emissions reductions from activities, such as farming and forestry, not covered by carbon pollution pricing. Voluntary participants in the program will propose projects that will offset or reduce greenhouse gasses, credited per metric ton, based exclusively on the protocols that the government publishes.

These credits can be used by entities subject to the OPBS as compliance units in place of keeping emissions under the cap, and are purposefully kept more affordable than the excess emissions charge so as to encourage their use. Since 2022 the government has published two protocols that are ready for applications: the Landfill Methane Recovery and Destruction protocol and the Reducing GHG Emissions from Refrigeration Systems protocol. Environment and Climate Change Canada is currently working on five more protocols: the Improved Forest Management on Private Land, Reducing Enteric Methane from Beef Cattle, Direct Air Capture CO2 and Sequestration, Enhanced Soil Organic Carbon, and Avoidance of Manure Methane Emissions through Anaerobic Digestion protocols. When complete, this system will work in tandem with existing provincial and territorial systems to create consistent standards allowing for trading of credits across Canada.

The price of a carbon credit is determined by supply and added value from sustainable co-benefits that buyers are increasingly willing to pay premiums for. The price of carbon credits from Canada's compliance market is currently $50 per tonne and will ramp up to $170 per tonne by 2030, making it very competitive. Compare that to the average price of a voluntary carbon market credit at $6.97 in 2023. This price falls very short of the $40–80 per ton range needed to keep global warming within 2 degrees celsius. Under a compliance system, more credits can be priced at the threshold required to drive significant emissions reductions.

Regulating the Fossil Fuel Sector

Separate from the carbon offset protocol but sure to link into it eventually, Canada recently announced that it is moving ahead with a nation-wide cap targeted specifically at the oil and gas industry, which is responsible for a quarter of Canada's emissions. As the fourth largest oil-producing nation in the world, Canada stands to make a real impact by regulating its fossil fuel sector. This sector is being told to reduce its emissions by 35–38% under 2019 levels by 2030. In order to reduce emissions by 80 million metric tons in six years while simultaneously permitting greater production of oil and gas, the strategy must center on cutting methane leaks. The Canadian Climate Institute posits that methane cuts could deliver a third of the promised reduction. The cap is designed to integrate with the OBPS and the new federal carbon offset market, as facilities can pay for allowances from better performing facilities or purchase offset credits in order to comply with the framework.

However, even within such a progressive country on the frontlines of carbon financing, there are regressive forces preventing the carbon savings from being delivered on promised timelines. The province of Alberta, producer of most of Canada's oil and gas, has indicated that it does not intend to take this measure seriously, citing the short timeframe as a serious threat to investment and claiming that even though it is not the intention of the policy, production will be compromised. Even the notion of limiting their pollution resulting from structural inefficiencies — essentially waste, and not even touching on the real issue at all, which is the downstream combustion of the fossil fuels that they sell — is too much for fossil fuel profiteers to stomach.

Unfortunately for those companies, decreasing emissions and increasing fossil fuel production are incompatible, as was at last acknowledged at COP 28 in December 2023. The main conclusion of the conference was that a "transition away" from fossil fuels is necessary. However, this transition is far from inevitable. If there is no political will to do the work necessary to tackle climate change, there can be no way. When heads butt over the course of events, compromise will be the way forward; but crucially — and this cannot be overstated — no longer at the expense of the planet and the world's developing nations that had little to do with bringing about the current state of the climate.

The Pros and Cons of Carbon Markets

Almost no matter what political camp you're in, most can agree that carbon markets are useful for leveling the economic playing field for clean energy technologies and incentivize lower emissions while letting market innovation take the lead. As Günter Thallinger, Chair of the UN Net Zero Asset Owners Alliance, wrote in a statement on the closing of COP28,

"Governmental carbon pricing is a necessary part of the climate policy toolkit required to achieve net-zero emissions and reach the Paris Agreement goals"

A marriage of carbon markets and traditional government regulation, such as that achieved by Canada through their greenhouse gas offset program, may be just the thing to shoo polluters and offset project developers down those innovative pathways faster than they would otherwise go. By manipulating the price of carbon so that it is high enough to be competitive but low enough to be more appealing than paying excess emission charges, if they exist, a national system can safeguard this nascent market and accelerate its growth to meet the needs and challenges of the climate crisis.

The carbon offset market has its shortcomings, many of which are summarized succinctly in Mike Grindle's article in The New Climate on the greenwashing present in many offset schemes. Some of the pitfalls of the system include creating an excuse to just spend money on offsets instead of engaging in direct emissions reductions and disincentivizing aggressive climate action policies because they would alter the baseline "counterfactual" scenario on which all carbon credits are based, i.e. the amount of carbon emissions that would have occurred had the carbon offset project not been in place.

The Canadian carbon offset program is not necessarily immune to these pitfalls, as the Department of the Environment acknowledged in its Regulatory Impact Analysis Statement in a March 2021 issue of the Canada Gazette:

"However, [using carbon offsets as compensation] could lead to the deferral of some strategic or technological improvements that the facility may have carried out in the baseline scenario to reduce its excess emissions."

The difference is that the Canadian system is self-aware, goal-oriented and designed to control these negative outcomes because it is a compliment to a pre-existing regulation on polluting facilities which lowers the emissions cap over time, specifically by 2% or 1% annually depending on how much the policy puts a particular industry's competitiveness at risk. Additionally, a quarter of the compensation that a polluter must pay for exceeding the cap must be a direct fee, so they cannot solely use carbon credits to stay in compliance. These safeguards constrict polluters' ability to continue polluting, while still giving them a choice: Either find a way to lessen your carbon footprint, or pay more every year to have it offset.

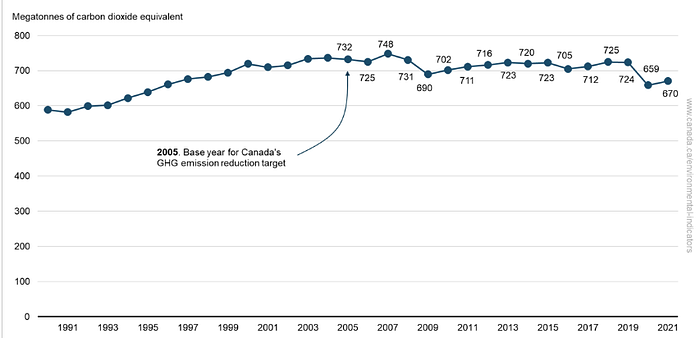

Unlike some other industrialized western nations, Canada seems to intend to deliver on its goal of net-zero by 2050, on the way to which the 2030 benchmark is of major significance because it represents a theoretical near halving of the nation's emissions. Even though emissions rose by 2% between 2021 and 2022, Canada has decreased its overall emissions by 6.5% below 2005 levels since setting the goals in 2016 (in 2021 it was 8.4% below). This reduction is equivalent to removing over around 19,000,000 gas-powered passenger vehicles from the roads for 1 year. While the country can be considered a global leader in climate change mitigation in a lot of ways, to reach its own goals and those of the Paris Agreement, they still have a lot of work to do.

Imagining Better Futures

With all this intellectualizing and back-slapping going on in the global arena, it is refreshing to see real progress being made at an incredibly swift pace. The methods may not be perfect, but there is no room for perfection in the race to mitigate climate change. Costs and benefits must be weighed, but in the end, we have to implement what our best science says could make the difference before we can be certain it will and adjust as we go.

We also have to keep imagining alternative futures, especially ones where carbon offsets will ultimately not be necessary. Because even if all carbon offsets were sound and safely stored carbon indefinitely, pollution, both resulting directly from fossil fuels and from the excessive lifestyles they enable, is something that we will still need to deal with — along with runaway global warming. For that reason, they are more of a means to an end, a way to transition to the low-carbon world we desperately need. Future generations will not forgive us for our fear of rocking the boat, because any inaction on our part will cause the one boat that we can't afford to rock — the one that we're all in together, earth, atmosphere and all — to sink.

"We have the solutions; we know what needs to be done. And action can no longer wait."

- Inger Anderson, Executive Director of UNEP