For a brief moment, just as I was typing the Russian Finance Ministry's website to check the status of the Russian National Wealth Fund, I had a feeling that it wouldn't open. I had my doubts, but I also desperately wanted to know its current status. It didn't open.

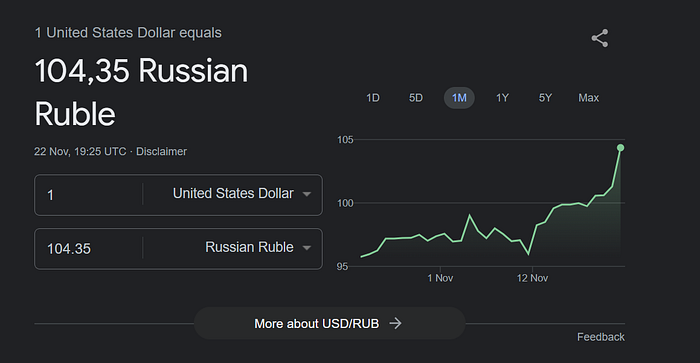

Of course, it shouldn't have opened because the Ruble has broken through the 100 barrier against the dollar like a hot knife through butter. How far it will go from here remains to be seen. I doubt we're in freefall territory yet, but I have no doubt that we are very close to it.

Although I was unable to find the latest status of Russia's national wealth fund, I do have the numbers from September, when Russia's savings piggy bank stood at $53.236 billion. More than a quarter of that asset is in gold. Russia has been quietly selling gold in the second half of this year, masking the fact that they were actually drawing money from the national wealth fund.

Gold Position in NWF:

- June — 329.795 tonnes

- July — 303.579 tonnes

- August- 298.84 tonnes

- September — 293.189 tonnes

The Russian Finance Ministry has blocked access to the data. I'm pretty confident they will keep it under wraps moving forward, especially since the ruble has crashed past 100 against the dollar. The way it broke through makes me think it won't return to pre-2024 levels.

There was no pause, no testing, no hit-and-retrace. It was a clean breakthrough.

But it's the ruble against the dollar.

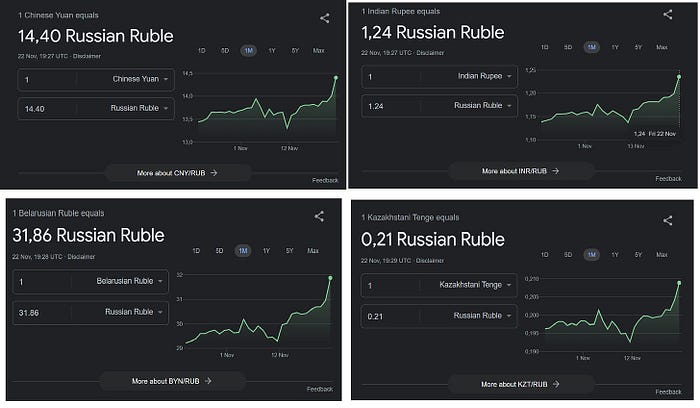

Russia doesn't conduct much trade in dollars, so why should they be concerned? Well, unless you live in the MAGA world, the reality is that the world is more interconnected than we think. When the ruble weakens against the dollar, it has to weaken against all major currencies.

The chart almost looks the same, doesn't it? The ruble has fallen sharply against the Chinese yuan, Indian rupee, Belarusian ruble, Kazakhstani tenge, and all other currencies.

It doesn't matter where Russia imports its goods from; Russians have to pay a lot more today than they did last month. The simple fact that the Russian central bank has not intervened to manipulate the supply and demand of the ruble to stabilize its price and keep it under 100 says a lot about the status of the national wealth fund. They don't have the funds to intervene, and they are uncertain about how much power they would need to stop the fall.

They've given up because depleting their cash reserves to prop up the ruble could actually hurt the economy more than the damage caused by the ruble's decline. They've chosen the lesser of two evils.

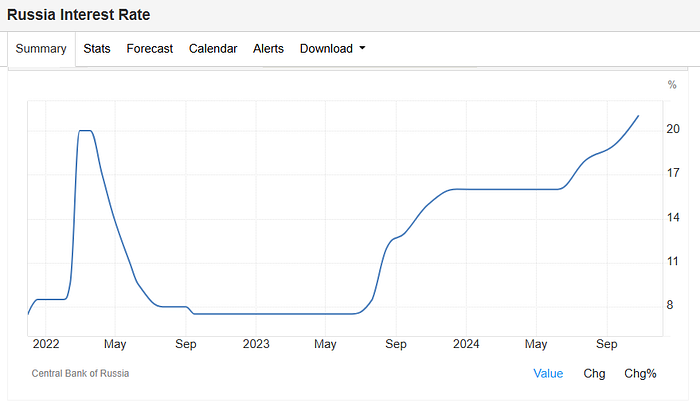

The first time the ruble broke past 100 against the dollar in April 2022, things were much different. The central bank quickly raised interest rates and backstopped Russian banks to prevent an exodus of money from the system. The ruble fell sharply after Western sanctions but quickly rebounded after the Russian central bank raised interest rates.

It's not going to happen this time because the interest rate is already at 21%. Russian central bank will most likely try to increase it further to see if the ruble can be stabilized above 100 and prevent it from entering freefall. That doesn't mean it will work, but it's still worth a try.

Whatever happens to the ruble from here on out remains to be seen, but what has happened in the past few weeks will only accelerate inflation further.

Inflation Impact:

Imported goods become more expensive: When the ruble depreciates, it takes more rubles to buy goods and services from other countries. If Russia relies on imports for essential items like oil, food, or manufactured goods, the prices of these imports rise. This increase in import prices often leads to higher overall living costs and inflation.

Production costs will increase: If Russian businesses rely on imported raw materials or intermediate goods to produce their own products, the cost of production increases due to the higher cost of imports. To maintain profit margins, companies will raise the prices of their own goods, contributing to inflation.

Demand for domestic products will increase: A weaker ruble makes foreign goods more expensive, which pushes consumers to buy more domestically produced goods. While this can help local businesses, it also leads to an increase in demand for these goods, which, if not met with an equivalent increase in supply, can drive up prices, causing inflation.

It's just not a great place to be when you're running a deficit budget, without enough savings, and no clear path to raise more debt from capital markets.

It's a disaster.

Will it cause the economy to collapse?

You never know. It's very difficult to predict with accuracy. But the very reason the Russian central bank hasn't intervened by dumping $5 or $10 billion into the market to stabilize the ruble should tell us that they themselves are very fearful of a collapse. Otherwise, they would have stepped in by now.

Putin must be in full panic mode. I'm not sure. I don't see the Indian government giving ten billion dollars to Russia, but will China provide them with money to escape, perhaps through a massive loan? It still won't stop all the problems, but it could buy a little more time for Putin.

Yo, Europe, make sure that doesn't happen.

You've got the buying power — make sure China is fully aware of it.

Thanks for reading. The war is getting closer to the end. Now, more than ever, it's crucial to make critical information about Ukraine accessible. That's why I've made 335 stories available to the public in 2024.